In my previous Substack essay Save the Cat?, I sought to define corporantism as a social, economic, and political lens through which to understand the millennial era.

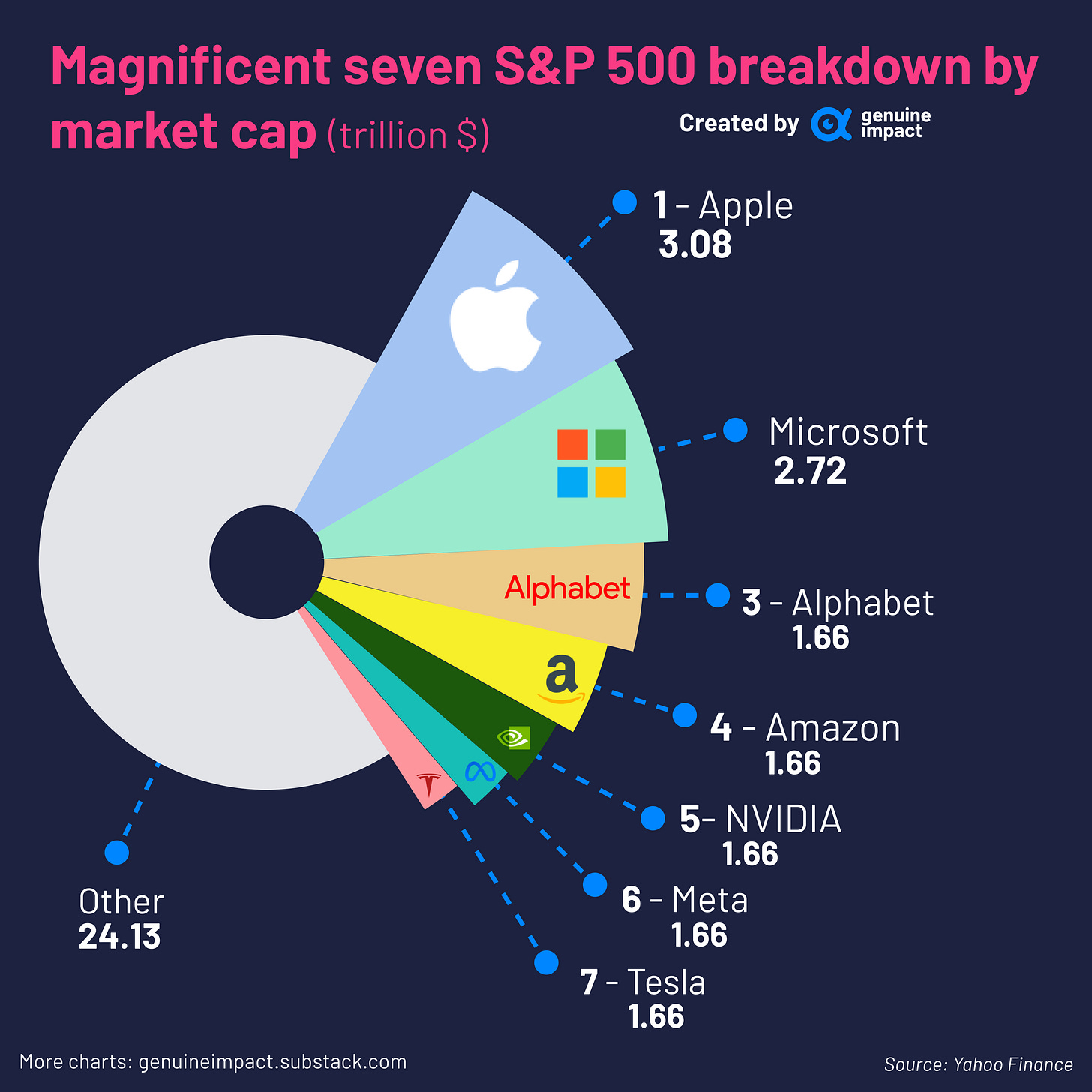

A friend who read that essay had a good discussion with me about Marxism and market forces, then encouraged me to consider a new essay that specifically focused on market forces. One of the things we discussed was the highly artificial valuations of the ‘Magnificent Seven’ of ‘Big Tech’:

The problem is that these are speculative valuations and it is very rare that valuations from stock prices (or any other means of speculative market valuation) will accurately reflect the true capital value of a corporation - only its likely value in sale.

This is because speculative trading (more commonly known as ‘gambling’) is, and always has been, a den of liars and charlatans who want nothing less than for the average citizen to know the capital value of a corporation.

In his 1989 book Liar’s Poker, American journalist Michael Lewis wrote about his short time as a speculative trader on Wall Street and humorously explained the ‘market forces’ at work in the backrooms of these speculative trading enterprises.

One who trades in speculative markets makes their money primarily through secret knowledge of ‘market forces’ that the layman is not privy to, so it is not in a trader’s best interest to divulge these secrets to the hoi polloi.

Instead, they use complicated graphical presentations and made up corporatese gobbledygook to explain the supposed ‘forces’ in play. This obtuse approach demonstrates their vast intellect, and is used to drum up investors willing to speculate that their theories are correct.

I. How Corporate Bureaucracies Go Wrong

I was first made aware of the ways in which corporate bureaucracies can go wrong by my Year 13 Economics class.1

Our teacher was a man in his late 50s, with an oratory flair about him similar to that of contemporary politician Winston Peters. He had worked in the bureaucracy of the New Zealand civil service and run small businesses during his early years, but settled on a cushy teaching job in his later life.

Our class had many foreign exchange students from China with rich parents and, outside of class time, he would help them learn how to invest capital in New Zealand.

These ‘high flyers’ wanted to play the stock market, but he explained that it is unwise to invest capital there without insider information. Land is a much safer bet, especially if they have citizenship or acquire it soon. If these students had good ideas for using their capital, then he would co-invest in their developments to help with the citizenship issue.

His class was unorthodox, and held many interesting discussions about the failures of bureaucracy in New Zealand. In one particularly amusing lecture, he displayed an organisational chart of the whole school and explained how few of the people listed on the chart provided any productive contribution to the primary output of a school: i.e. educating students.

I wish I had that slide to show you now, but I do have this short film I directed later that year. In it, my dad plays Mr. Wilson - a math teacher who has a cheating scandal in his classroom.

Lee: “That test would have given me UE. That test was the difference between me performing at Carnegie Hall, or on Manchester Street. I would have failed that test, fortunately I wasn’t the only one who needed me to pass.”

Hal: “So… Mr. Wilson approached you?”

Lee: “Yes and no, I wanted to do it… properly. But, he had a different approach. I went along with it, as far as it would go.”

Hal: “What did he have to gain?”

Lee: “I think you can answer that for yourself. You know, the Head of Math just had a mental breakdown and Mr. Wilson’s wallet was aching…”

The financial incentive to lie is a fertile one indeed.

While I cringe at the knowingly noir inflections of this high school dialogue, it was an attempt to get at the failing of bureaucratic corporations as a model of governance: they are too prone to corruption, lies, and lazy work from their undervalued employees.

A bureaucrat is merely a vessel for their corporate employer, and has little free agency with regards to public affairs. Holding a strong, public opinion is unpopular - unless it suits the vested interests of their masters, in which case one of these poor individuals is forced to hold an unbreakable belief in their corporation’s opinion.

Unfortunately, if this corporate opinion proves unpopular in the market, the employee will be forced to shamelessly recant their previously strong belief when the corporation moves on from it. This leads to a lot of uncertainty in the administrative affairs of these important bodies of our corporant society:2

As we can see, corporate bureaucratic entities do not value real actions - risky business like performing real actions could have real consequences.

Instead, they find ways to theorise about how one might take action - avoiding doing anything that might upset the delicate equilibrium of safety they have in their Imperium of Man. Meanwhile, real wars rage just outside their window…

II. The ‘Free Hand’ of the Market

These real wars are the actual market forces at play. Outside the bureaucratic and ever shifting theoretical world of speculative trading (a popular past time of most financial institutions), there is a real economy that exists amongst human beings.

The best explanation of how these humble citizens tend to trade amongst themselves are still the ones offered by Adam Smith in his seminal text, An Inquiry into the Nature and Causes of the Wealth of Nations (1776).

People who have read this text, and have a realistic understanding of speculative trading, tend to understand the economy of trade that Smith considers to be logically observable in the world of nation states.

However, the rise of ‘Big Tech’ and ‘Big Government’ as well as ‘neo-marxism’ and ‘neo-liberalism’ mean that there is an ideological incentive to lie about the logic of Smith’s work to justify whichever theories support the political stance one chooses to hold.

Unfortunately, this means it is very hard to have a conversation with anyone in the modern ‘personal is political’ age about Smith’s work. Specifically, one can no longer easily discuss the logical propositions he makes for the phenomena or ‘forces’ that underpin the way in which humans naturally trade amongst themselves.

Citizens have mostly been fed his ideas second hand, then told he is a ‘capitalist’ or ‘early Economist’ or other such nonsense.

The problem is that Smith was not an ‘economist’, the field of Economics was largely derived from Smith’s field work and observations. Smith was a moral philosopher, and while he observed and categorised many of the phenomena that would later come to be criticised as ‘capitalism’ by Karl Marx and other ‘communist’ thinkers, he came from a unique school of moral thought.

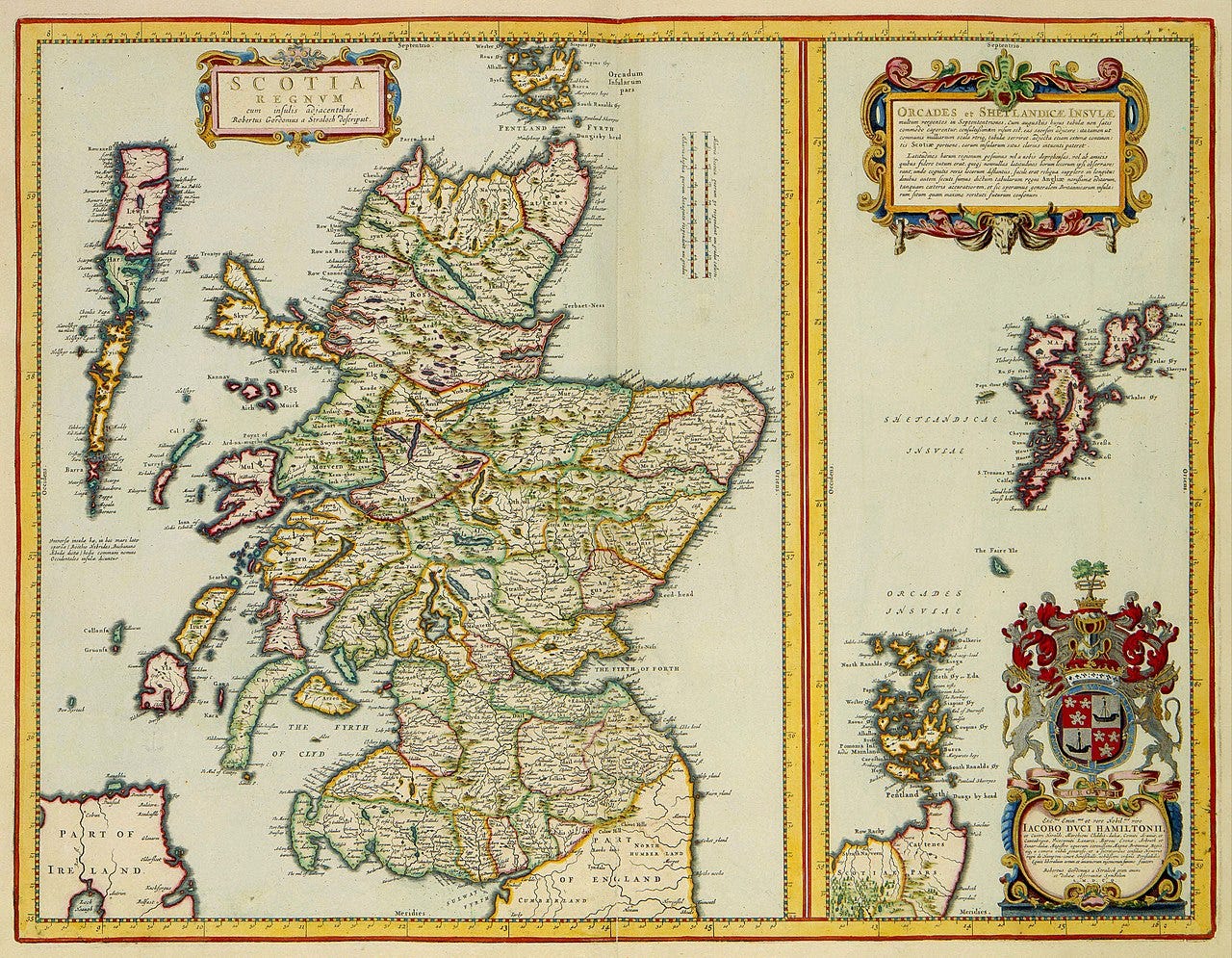

Smith’s moral stance is not that ‘capitalism’ is inherently evil. Instead, he came from the famously ‘cheap’ and ‘industrious’ nation of Scotland, and had a patriotic sense of pride in the smarts of the Celtic peoples.

He criticised inefficiencies in the market across many nations, including his beloved homeland, but from the point of view that trade amongst humans held some form of inherent ‘positive’ value. In general, he believed that free trade amongst free peoples was a net good for humanity. However, most humans were not free…

"We rarely hear, it has been said, of the combinations of masters, though frequently of those of workmen. But whoever imagines, upon this account, that masters rarely combine, is as ignorant of the world as of the subject. Masters are always and everywhere in a sort of tacit, but constant and uniform, combination, not to raise the wages of labour above their actual rate.”

“Masters, too, sometimes enter into particular combinations to sink the wages of labour even below this rate. These are always conducted with the utmost silence and secrecy till the moment of execution; and when the workmen yield, as they sometimes do without resistance, though severely felt by them, they are never heard of by other people".

“In contrast, when workers combine, ‘the masters [...] never cease to call aloud for the assistance of the civil magistrate, and the rigorous execution of those laws which have been enacted with so much severity against the combination of servants, labourers, and journeymen’."

As we can see, Adam Smith is not some ‘capitalist’ ogre who wants to ‘uphold the tyranny of the masters’ as some revisionist or politically motivated thinkers like to claim when dismissing Economic explanations for the failures of their policy ideas.

While Smith did occasionally interject asides of his own moral feelings on matters, he mostly provided a phenomenological report of observable ‘forces’ that could be witnessed in the ways that humans generated ‘wealth’ through ‘trade’. He then mapped these forces out, and the field of Economics is largely the attempts of theorists who followed Smith to debate whether his observations were correct.

Your mileage will vary on which observations he got right or wrong, but I encourage any reader to check out his book. The way in which he reports his observations is brilliantly witty, and he seems generally aware of his own biases in interpreting the observations.

III. The Corporant Economy

Now we come to my main objection to the state of the current corporant economy I codified in my last essay, Save the Cat?

I feel that free trade amongst free humans is a good thing, and that corporate entities bind humans into servitude to prevent them from freely enacting their economic powers of trade.

However, corporate entities are capable of achieving great feats and it is unlikely any truly free association of humans could achieve similar feats. This is why Tyranny always seems to emerge from any form of ‘communism’ predicated on Marx’s theories:

The ‘free associating’ humans of communism are not organised enough to challenge the ‘capitalist’ humans who use corporate models of enterprise.

Eventually, to keep pace with ‘free enterprise’, a Tyrant emerges to control the people and their economic output with an iron fist - normally through a corporate bureaucratic order known as the ‘One Party State’.

In fact, there is a compelling argument to be made that China (a nominally ‘communist’ nation) achieved economic resurrection because of the genuinely free trade that emerged amongst their poor farmers when their Tyrant and his communist state lost the ability to control them.

American historian and political commentator Stephen Kotkin outlines the forces behind the limited revitalisation of the Chinese economy in this interview for the Hoover Institute broadcast Uncommon Knowledge: 5 More Questions for Stephen Kotkin:

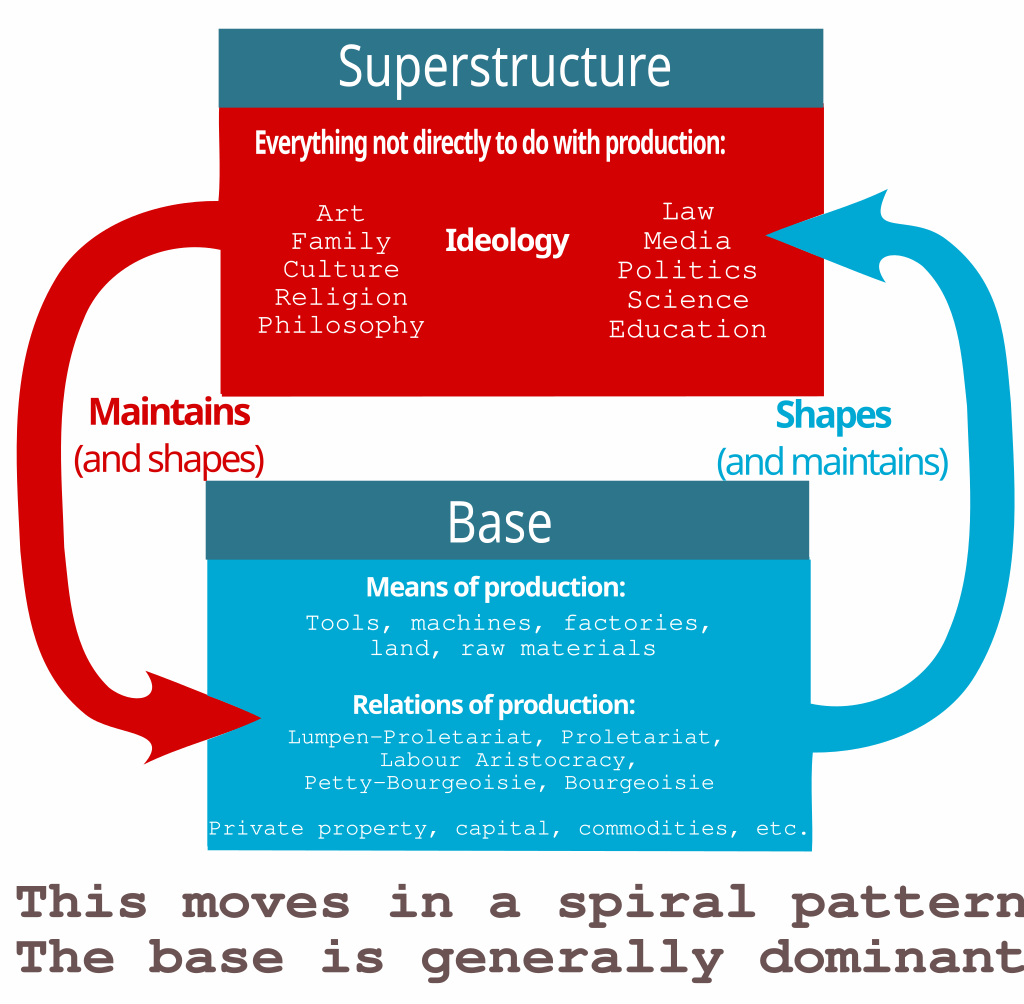

Stephen Kotkin: “And you can only imagine how far that goes. And so when you liberalize, economically, there are limits to that as well, because it's a threat to the communist monopoly to have independent sources of power created by markets and entrepreneurs. And so we're seeing the crackdown on the private sector by the communist party because it threatens their monopoly. The perception is under, Marxists, that politics is only the super structure. And underneath is the so-called base or the mode of production, the socioeconomic relations. Well, the socioeconomic relations, if they're determinative and they're capitalists, what's gonna to happen to the Leninist political structures, the super structures?”

“They're not gonna survive in the Marxist thinking. And it turns out, in reality, not just in Marxist thinking, but in reality, opening up your economy and allowing legal private markets is a threat to the party's rule. So now they're reinserting communist party officials and communist party committees into private sector companies. And so you have a CEO and a board, and then you have a party machine that's saying this has to align with the mission of the party, meaning it can't threaten the party's monopoly.”

This modus operandi of corporate bureaucracy is shared by contemporary political thinkers and leaders across the world (not just in China, though most other nations insist on some form of ‘two party’ system to hide their corporate bureaucratic machinations).

Unfortunately, based as it is in Marx’s conception of ‘communism’ vs ‘capitalism’ as the warring ‘modes of production’, it has warped the general understanding of what Economics is as a philosophical mode of inquiry.

The goal of wise economic discourse is not to make grand pronouncements about ‘modes of production’ being good or evil but to examine the forces of ‘enterprise’ that are at play in how goods and services are traded by humans. How the impact of these ‘natural’ forces can be seen in politics, bureaucracy, and governance is a secondary concern, and how they impact on morality is a personal concern.

i. Rational Economic Discourse

Unfortunately, rational discourse has increasingly disappeared from political understandings of economics as corporantism has set in across our societies.

The best explanation I have seen for how the ‘real’ economy of human trade has largely been replaced by a ‘fake’ economy of corporate trade is this video from Australian YouTuber Dagogo Altraide’s channel Cold Fusion:

“After almost fifteen years, the 2008 recession has taught us several lessons. It was the loose lending standards, and low central bank interest rates, that started the problem. Financial engineering spread it to the world.”

“Bad policy, accounting fraud, and poor credit rating agencies fan the flames. Although structural reform has taken place since 2008, we should also take a deeper look into central banks and their decisions. They always seem to print and leave rates too low and for too long, distorting markets and blowing up bubbles - only to pop these bubbles later.”

“It’s a scenario that seems to be playing out again today. All in all, the real lesson that we as a society never seem to learn is to keep those in charge accountable, and also to plan for the unpredictable. So, for you personally, what can you do if you’re worried and don’t trust our expert leaders?”

While he is shilling a bit at the end of this presentation, he does raise a good point that the problem in our modern corporant society is that our ‘experts’ have lost all ability to realistically assess the ‘risk’ of their financial endeavours.

Corporate bureaucracies, the most dominant system or ‘mode of production’ in our contemporary socioeconomic framework, assess risk based on how likely they are to be blamed if something goes wrong - not how likely they are to be praised if something goes right.

Fear mongering political activists hurl ‘Marxist’ slurs at them like ‘capitalist’ or ‘communist’ if they even hint at sound economic principles, and genuine economic studies about the work of these activists and their corporant theories of human behaviour go under reported.

ii. The Bureaucracy of Acronyms

So, why don’t we apply logic to Economics anymore?

In my last essay I talked about the logical paradoxes at the heart of corporant contemporary society, but nowhere are these paradoxes more clear than in the current D.E.I (Diversity, Equity, Inclusion) and E.S.G (Environmental, Social, Governance) movements that are sweeping through corporations across the globe. These movements have their origins in the Critical Theory of Marxist academics, particularly in Marx’s conceptions of the ‘base’ and ‘superstructure’ of economies.3

As we can see from the graphic above, the basic claim of ‘critical theory’ (those who apply Marx’s theory to critique the ‘mode of production’ known as ‘capitalism’) is that our base ‘means of production’ are controlled by ‘capitalists’ instead of the ‘common people’.

This means that both the base and the superstructure of ‘ideology’ that emerges from this base (i.e. ‘capitalism’) are inherently ‘bad’ as their ‘power structure’ supports the ‘rich capitalists’ over the ‘poor workers’. D.E.I and E.S.G are seen as some of the ways for critical theorists to rectify these forces…

These two dominant critical theories are essentially based on the principle of ‘equity’, which is taken in these formulations to mean ‘equality of outcome’ and not ‘equality of opportunity’.

The reason for this is that ‘equality of opportunity’ is an idea of the ‘capitalist superstructure’ that oppresses thinkers who challenge ‘capitalism’. Instead, with ‘equality of outcome’ or ‘from each according to his means, to each according to his needs’ the ‘base mode of production’ can be made more fair.

This will free workers from the Tyranny of the ‘capitalist superstructure’ and allow them to make a ‘communist superstructure’ based upon the new, free, fair, and Communist ‘base mode of production’.

Unfortunately, as Stephen Kotkin explained above, this is a fallacious form of logic.

The problem is that Smith did not write a ‘capitalist superstructure’ into being when he made his observations in 1776, he simply observed the ‘natural’ phenomena present in how humans organised to marshall their resources and trade them.

Whenever theorists like Marx have sought to create a new ‘mode of production’, they have asked humans to act in an ‘unnatural’ way, and the inevitable result is that a new Tyrant emerges in their supposedly ‘communist’ or ‘free’ society.

Eventually, these theorists see how inefficient their new ‘mode of production’ is, and adopt an ineffective form of ‘neo-liberalism’ or ‘neo-marxism’ to replace the ‘capitalist’ mode of production that Smith observed to be naturally occurring amongst humans in diverse ‘nation states’.

As Economics has declined as a serious discipline and been replaced with Marxist Critical Theory, corporations have hired Critical Theory experts to implement a social justice policy into their businesses through ‘sensitivity training’.

These D.E.I training seminars then improve a corporation’s E.S.G score, making it more likely that they will receive investments from banks and other financial instiutions that use E.S.G scores as a metric in funding decisions.

Unfortunately, this noble attempt to cure humans of their ‘predjucial biases’ with seminars that teach workers who are ‘white’, ‘hetero-normative’, ‘cis-gendered’, ‘male’, or otherwise of the ‘oppressor class’ to be ashamed of their ‘privilege’ and ‘racism’ against the ‘oppressed class’ of ‘minorities’ and other ‘marginalised people’ has backfired.

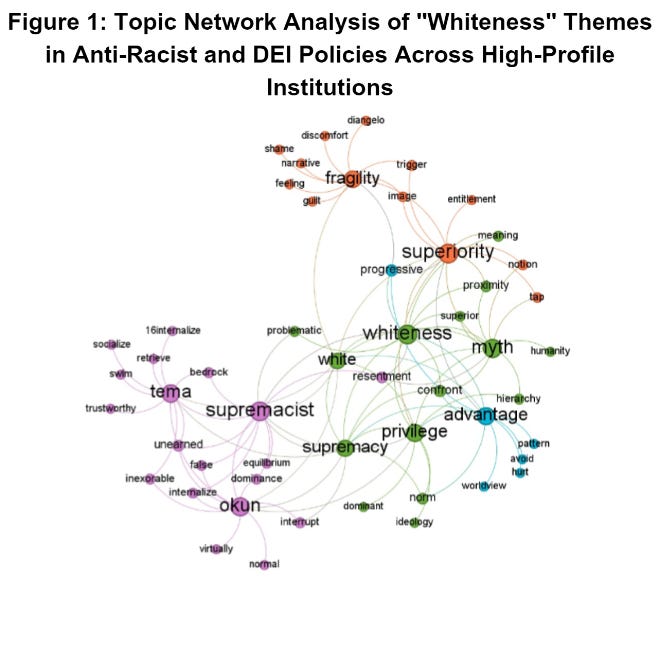

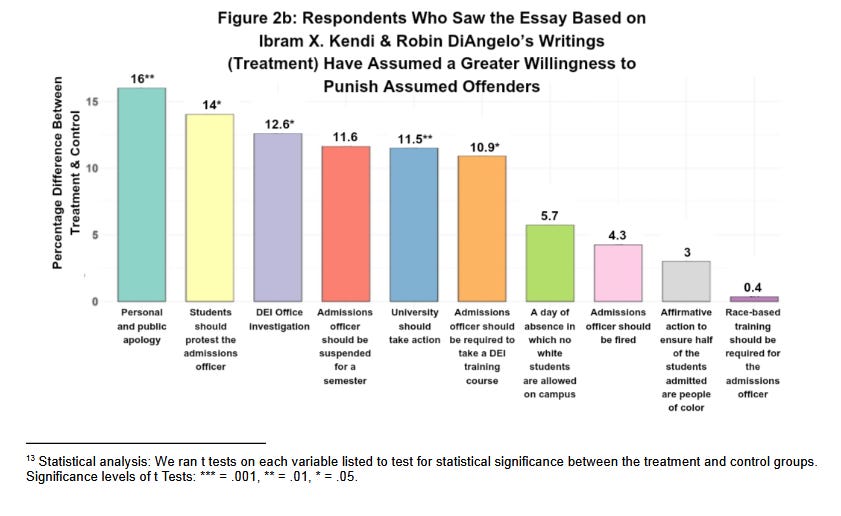

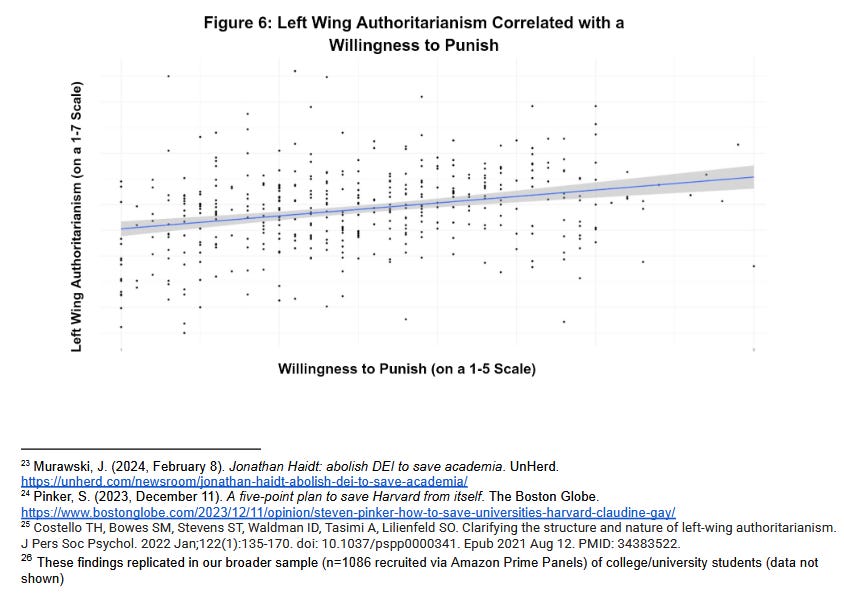

A recent study by Rutgers University and the Network Contagion Research Institute titled Instructing Animosity: How DEI Pedagogy Produces the Hostile Attribution Bias (2024) has been released, and the researchers state that these ‘sensitivity training’ seminars have actually increased the ‘hostile attribution’ bias of participants.

That is to say, that people who go to these seminars grow increasingly likely to attribute a ‘hostile’ motive to the actions of their co-workers, and more likely to punish them for transgressing against ‘morality’ with their ‘hostility’:

Unfortunately, these findings have been under reported by the legacy or ‘mainstream’ media.

According to National Review, the New York Times and Bloomberg were going to publish articles about the findings but, as these companies already have D.E.I & E.S.G. obligations and adherents to these policies on their editorial boards, they scrapped the articles once the outcome of the study was revealed.4

However, these recent findings mostly concern American corporations, in New Zealand we have been dealing with corporantism, and the primacy of theory over logic in our economy, for quite some time…

IV. The Productivity Crisis

While America has its own problems with corporantism in the form of D.E.I & E.S.G, in New Zealand we have long maintained the same consistent problem with corporate bureaucracies - our shocking decline in productivity.

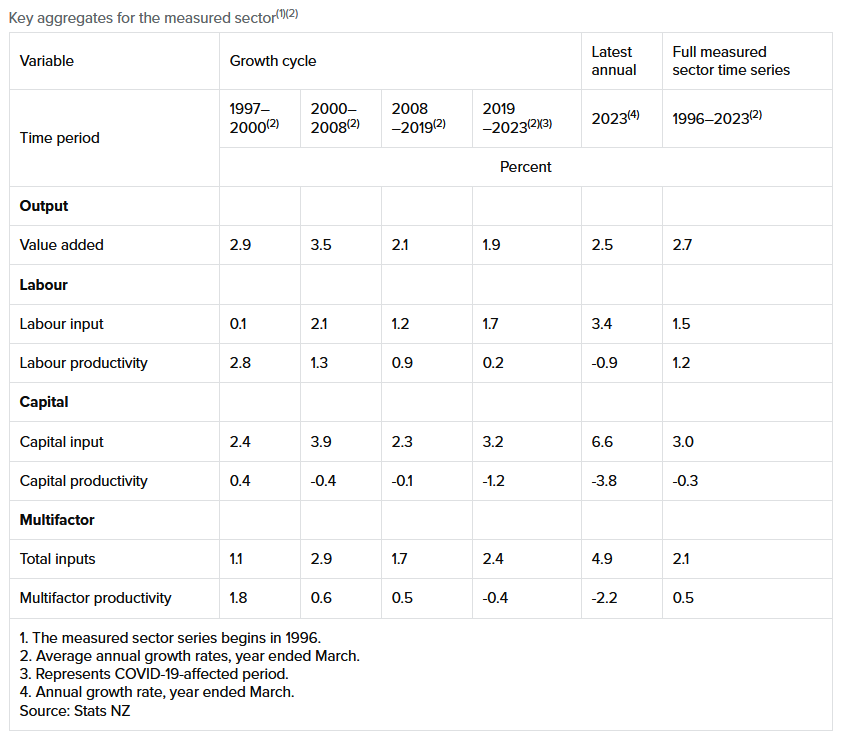

In recent years the critical theory movement has made scurillous revisionist presentations of our history, economy, and ‘race relations’ in an attempt to engender a more Marxist ‘mode of production’ in New Zealand,5 but the key failling of corporantism in New Zealand has always been our declining productivity outputs:

As the chart above demonstrates, there is a problem with productivity. Even though inputs have flucuated in the New Zealand economy, the productivity value of their outputs has declined in New Zealand for my entire life. This simple problem was easily explained in my high school economics class, and I’ve been amused by it ever since.

It was clear to my teacher that the large bureaucracy of our school was clogging up the ‘means of production’ and making it inefficient.

Essentially, he posited that while massive amounts of state capital and the bureaucratic labour of Kiwi citizens was being put into our school, very little of it had a direct effect on the productive output of our school: educating students.

Instead, most of our school workers ‘productive time’ was spent on meetings and emails: Meetings about holding meetings, meetings about the failures of the previous meeting, gossip about why after the previous meeting a teacher had sent an email to their Head of Department, and so on…

All of the classic hallmarks of the idiocy of bureaucracy that British historian C. Northcote Parkinson described with Parkinson’s Law or the Pursuit of Progress (1958):6

“Committees, it is nowadays accepted, fall broadly into two categories, those (a) from which the individual member has something to gain; and those (b) to which the individual member merely has something to contribute. Examples of the (b) group, however, are relatively unimporant for our purpose; indeed, some people doubt whether they are committees at all. It is from the more robust (a) group that we can learn most readily the principles which are common (with modifications) to all. Of the (a) group the most deeply rooted and luxuriant committees are those which confer the most power and prestige upon their members. In most parts of the world these committees are called ‘cabinets’.”

The problem, as Parkinson humorously outlines, is that the people who organise committee meetings have an economic incentive to organise further committee meetings. Citizens, workers, politicians, and all other humans who want to achieve productive ends loathe committee meetings - principally because these meetings are organised for the benefit of those who like to hear themselves talk, and not those who want to solve problems.

Unfortunately, running any kind of corporate enterprise requires committee meetings. I myself have participated in various committees as a middle manager, and in my local creative community. Many of these committees did eventually achieve productive ends.

However, these productive ends were frequently stymied by politics, blather, and the perverse economic incentives that dominated oratory proceedings.

I was warned of this in high school. My Economics teacher explained that both the unions favoured by ‘neo-marxist’ workers and the economic managers favoured by ‘neo-liberalism’ proponents could not solve this intractable productivity issue. This was concerning to me, as ‘neo-marxism’ and ‘neo-liberalism’ appeared to be the only sides of the debate that held any political capital amongst citizens.

Not to worry, he said, the market will eventually correct.

Given time, the foolishness of both ‘neo-marxism’ and ‘neo-liberalism’ will become so manifest that they will lose ‘capital’ in the market of ‘political votes’. As political parties are corporations who seek ‘political votes’ they will be forced by the realities of the ‘political market’ to abandon economic policies predicated on these theories and eventually the natural logic of ‘market forces’ will present a productivity theory of some description that gains political capital.

This was an expression of the ‘free hand’ or ‘invisible hand’ of market theory that is associated with Adam Smith’s work. Essentially, the market is a natural equilibrium that will always self-correct given time.

While political, bureaucratic, military, or other corporant machinations will cause gross inefficiencies during short term cycles, over the long term the ‘market’ in all fields of economic inquiry will remain broadly stable.

V. Polymarket vs Political Pollsters

Having demonstrated the basic principles of ‘market forces’ I’ve picked up over my years in business and personal study, I’ll leave the reader with some quick thoughts about market theory in the realm of political affairs.

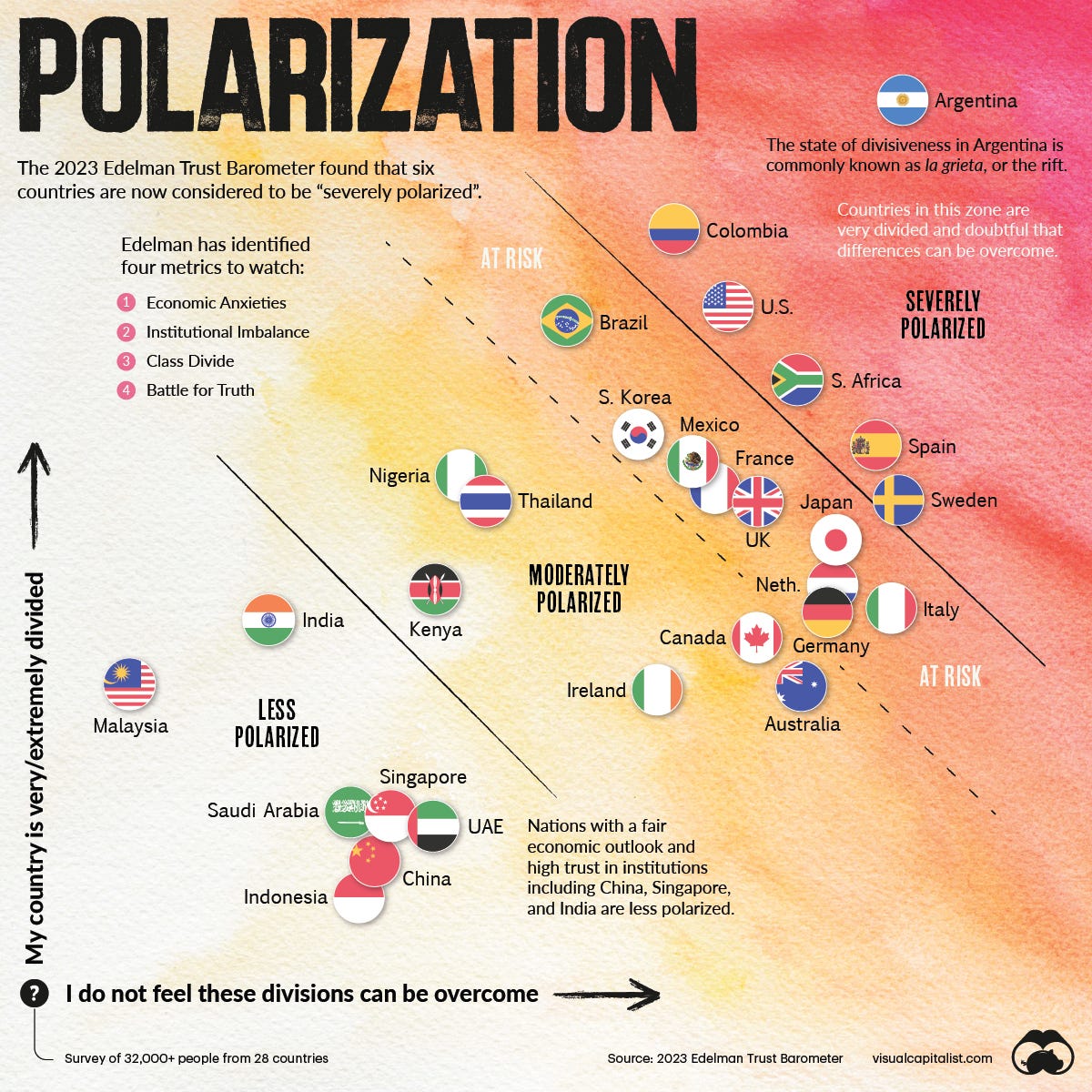

Given time, the ‘political market’ should correct for the distortions of ‘neo-marxism’ & ‘neo-liberalism’ and adopt a more logical approach to financial management. However, from outside appearances, political affairs have never been more ‘polarised’ between these two political ideologies of economics.

This ‘polarization’ is merely an illusion propogated by ‘political capitalists’ aka political parties who manipulate data in propagandist media presentations. This is a cunning attempt to ‘manufacture’ the consent of voters during election cycles by convincing them that ‘experts’ agree their political party is worth the ‘investment’ of a vote.

Never have the machinations of ‘political capitalists’ been more apparent than during the 2024 U.S.A Presidential Election Cycle.

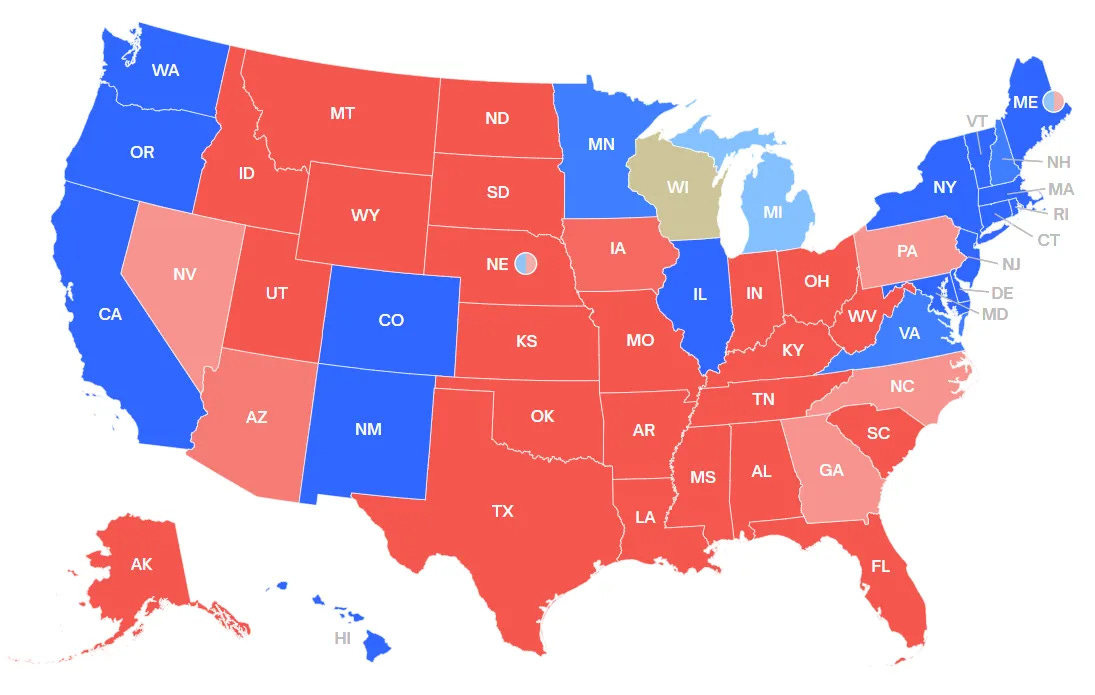

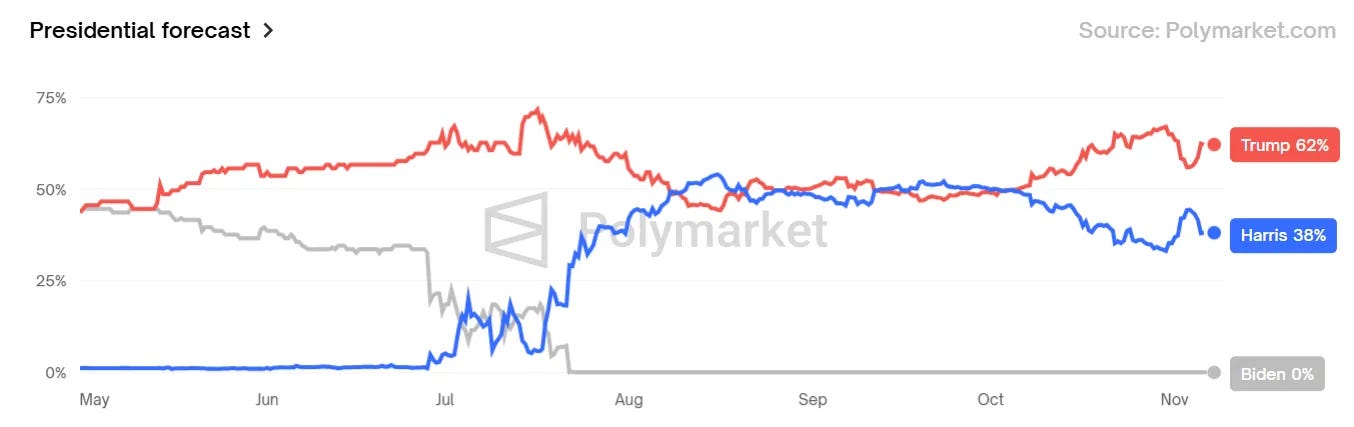

I live in New Zealand and our local media ran consistent stories about how tight the race was going to be. The same thing happened across the developed world: political pollsters presented recent studies to the public in media presentations, then explained how it was a ‘neck and neck’ race between Kamala Harris and Donald Trump. However, this is not what the market said:

Those of us who had been following Polymarket, an innovative new economic experiment in electoral polling, had seen a long term trend that the Jacksonian economic policies of Donald Trump’s coalition were likely to ‘trump’ the ‘neo-marxist’ & ‘neo-liberal’ policies of the economists who had sided with Kamala Harris.

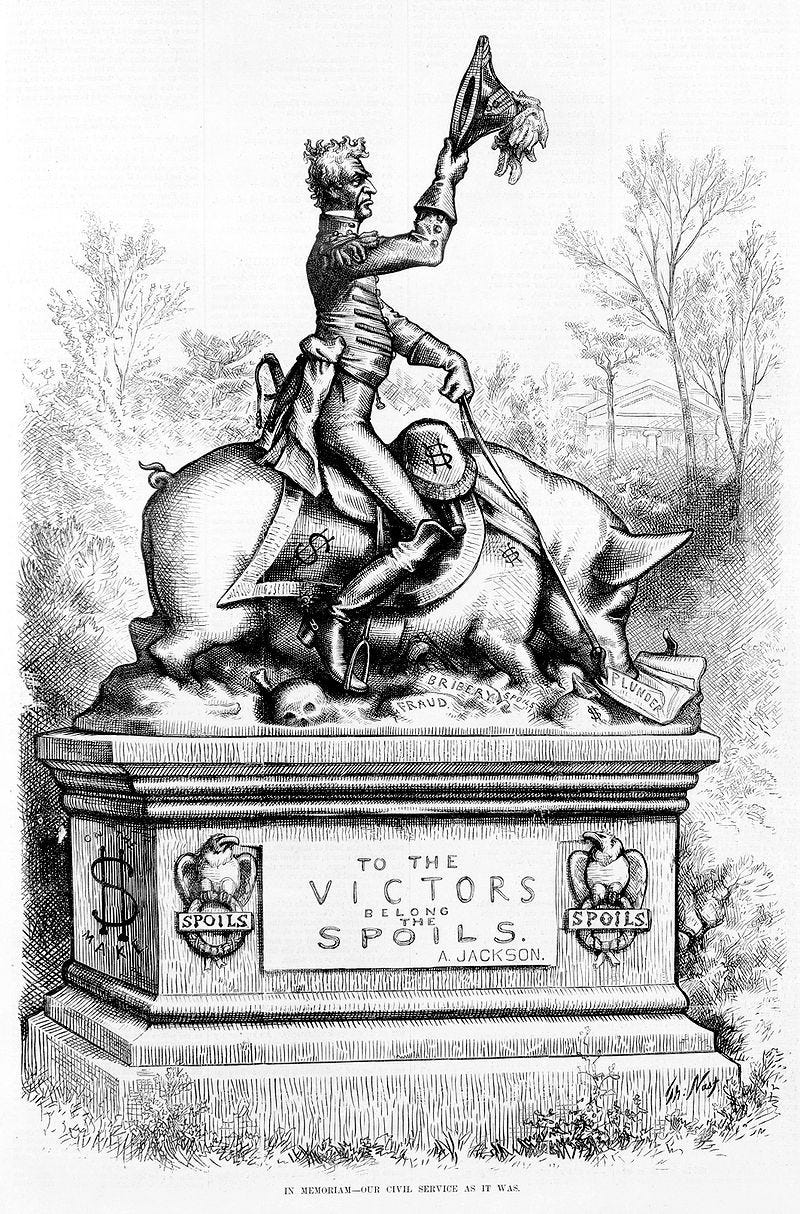

Unfortunately, as a Kiwi, I remain skeptical about Jacksonian economics as the solution to productivity and corporantism in western societies.

The threats of tarrifs emerging from our strong trading partner in the Pacific (not to mention long time fellow member of the Five Eyes alliance) are a rhetoric that has caused much disturbance amongst our Kiwi citizenry. I’m slightly more in favour of a Jacksonian ‘spoils’ system than the current pablum of ‘neo-marxism’ & ‘neo-liberalism’, because at least in a Tyranny there is some form of productive order, but feel both of our societies can do better.

However, I remain optimistic that ‘market forces’ are indeed logically self-correcting and in time the smart and wise thinkers amongst us will come to a genuine understanding of ‘economic theory’ or the logic which permeates human exchange of goods and services and the ‘market forces’ that can be observed from this phenomena.

The senior year of High School in New Zealand is Year 13.

For first hand accounts of these failures in contemporary New Zealand life, check out Punishingly Haimoana - this Substacker was a PR worker in various local bureaucracies: https://substack.com/@haimona/p-149736016

https://en.wikipedia.org/wiki/Critical_theory

https://www.nationalreview.com/news/dei-training-increases-perception-of-non-existent-prejudice-agreement-with-hitler-rhetoric-study-finds/

Substack is full of thinkers who decry the poor scholarship of the modern ‘critical theory’ movement in New Zealand. Here’s a recent article by Peter Alan Williams about a book he considers to be of low scholarly merit that has been circulated around New Zealand secondary schools:

In my last essay I noted this title as Parkinson’s Law and Other Studies in Administration (1958), but the PDF I have of the book has the title Parkinson’s Law or the Pursuit of Progress - it appears to have had different subtitles in different publication runs…