Public/Private Partnerships in the Multinational Age

Are the current regulations around multinational corporations fit for purpose?

This is my first attempt at writing a Substack article after becoming increasingly interested in the platform over the last year.

I thought my first article would be the lyrics for a new song I’m writing called The Dying Citizen (inspired by Victor Davis Hansen’s book of the same name), but instead I’ve been spurred to try my hand at writing by today’s news about the collapse of SolarZero.1

This news hit me hard because, back in 2018, I owned a house in Wellington and had SolarZero panels installed on my roof. It looked like a great way to cut down on my household power costs and their long term goal of setting up a solar power grid by installing panels on private homes seemed like a cool thing to be a part of.

There were no upfront costs, the installation process was smooth, and the panels helped me get an article in the local paper when I sold up in late 2019.2

In fact, the eventual purchaser made specific mention of the panels as one of the reasons she chose to buy my house.

She viewed it as an investment property whose purpose was to extract maximum rent from students attending the nearby Massey University campus, and felt the panels would help her attract environmentally conscious young people that would pay a higher rent to live more sustainably.

I didn’t like her approach to home ownership, but she offered a lot more money than anyone else and my real estate agents had been pushing the investment property angle pretty hard.

I’ll be honest that I don’t feel a lot of pity for where the collapse of SolarZero leaves her on this investment, mostly because she charged outrategous rents and gutted the lounge to turn it into a seven bedroom property with little concern for the wellbeing of her tenants.

My view is that a 90sqm property with seven bedrooms, no lounge, a tiny galley kitchen, one shower, and two toilets is not fit for purpose - but she disagreed and the NZ housing crisis meant she was able to find tenants willing to live there.

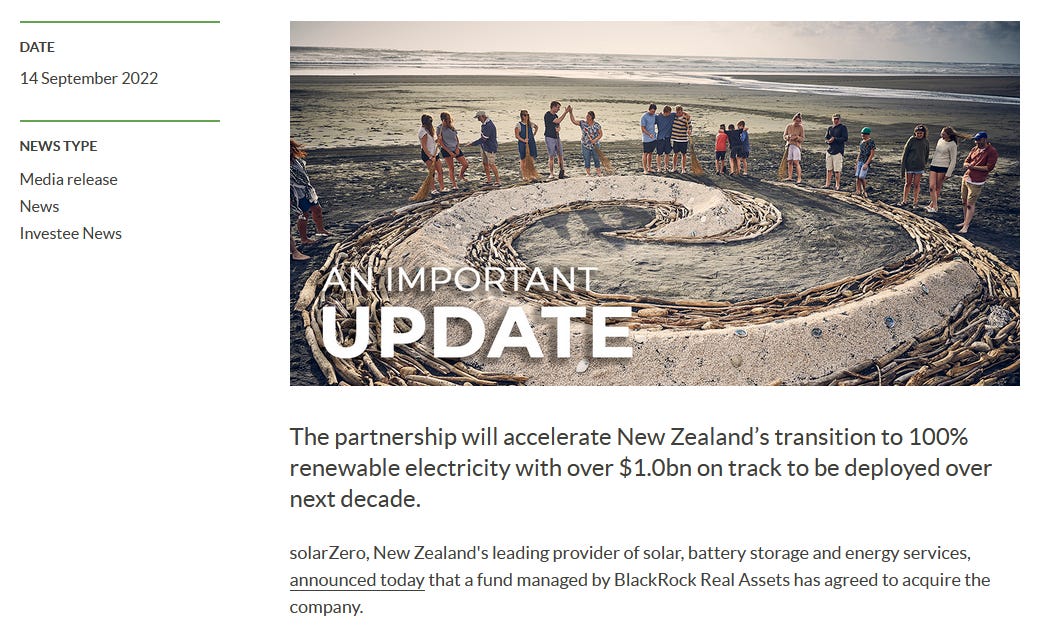

When I was dealing with the company, SolarZero was privately owned with investment capital provided by local philanthropists like Sir Stephen Tindall. Clearly their business model was appealing though, because in 2021 the government invested in the company through the NZGIF3 and in 2022 it was purchased by BlackRock Real Assets who had promised to invest $1bn over the next decade.4

This is where we reach the crux of the article. Through a series of corporate machinations, SolarZero went from being a private philanthropic enterprise geared around helping home owners and improving energy resilience to becoming a public/private partnership between NZGIF and BlackRock Real Assets that appeared more focused on greenwashing and climate doomerism5 than helping average Kiwis.

To put this statement in context, here is what the CEO of SolarZero said in 2022 when it was sold to BlackRock:

"Kiwis want clean and resilient energy. BlackRock Climate Infrastructure team's investment and backing will enable us to rapidly scale, grow our energy services network, and accelerate the transition to a 100% clean energy future.

By 2030, 50% of the world's energy will be generated in the Asia Pacific region. The window to prevent the worst impacts of the climate crisis is closing fast and the power couple of solar plus storage is one of the few true paths to energy security, stable power prices, prosperity, and a liveable planet."

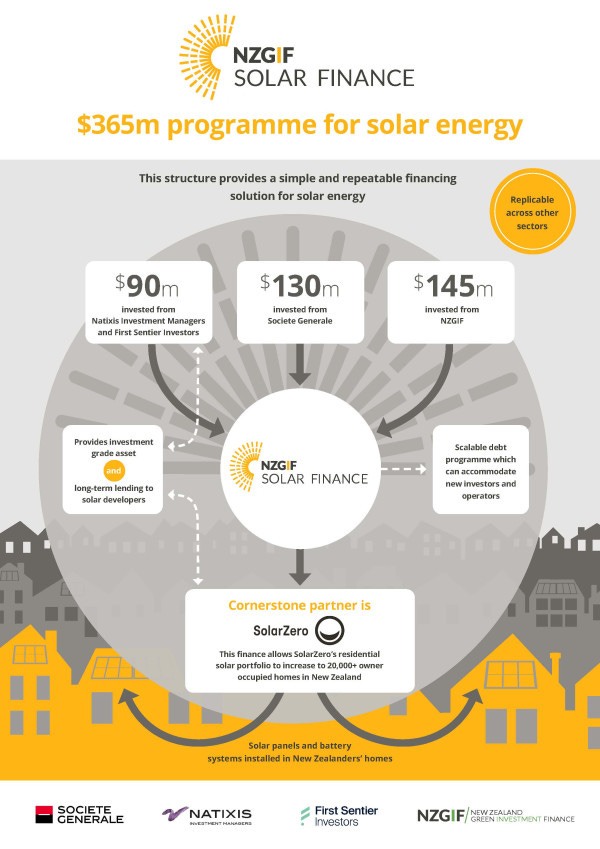

Clearly this was a foolhardy strategy, but it seems like no one in the government or the lower echelons of SolarZero was aware of how close the company was to bankruptcy and liquidation prior to the news breaking this morning. In August, the NZGIF announced it had raised an extra $365m for the company and touted the genius of its investment strategy with this graphic:6

Notice the ‘replicable across other sectors’ circle in the top right of the graphic. Not only was NZGIF patting itself on the back for engaging in a public/private partnership that has failed just a few short months later, it thought their strategy was so good that it should be broadly replicated across the NZ economy.

SolarZero is not BlackRock’s only investment in New Zealand, our last government partnered with BlackRock to create a $2b climate investment fund in 2023.7 Former Prime Minister Chris Hipkins had this to say about it:

A boon for Kiwi businesses? Tell that to the workers who SolarZero sacked right before Christmas after promising them the company was in great shape earlier in the year. This quote from a software engineer at SolarZero sums it all up:8

“It’s yet another example of unaccountable multi-nationals negatively impacting the lives of many New Zealanders, who have no legal protection over their outstanding pay. This is a clear example of why the Government needs to introduce more stringent laws around employee protection in the case of liquidation. A great example of the worst of capitalism – pushing workers extra hard before pulling the rug out from under them.”

So, what protections do we have in New Zealand right now around overseas investments? Well, in 2005 Prime Minister Helen Clark’s government passed the Overseas Investment Act to make it clear that investing in New Zealand was a privilege for foreign companies and that the economic benefits of these investments would need to be weighed against risks to our national interests.9

This law was invoked in 2022 when SolarZero was sold and LINZ decided that the economic benefits outweighed the risks.10

The failure of SolarZero demonstrates that we need to rethink the balance of this act, perhaps to create more certainty for workers employed by multinational companies operating in New Zealand, but our current government appears to be going in the opposite direction.

They are currently in the process of loosening the regulations of the OIA and this is the reasoning provided by Associate Finance Minister David Seymour:11

I expect the opposition will challenge this and use the failure of SolarZero in parliament when this new legislation is debated, but let us not forget that the current leader of the opposition is Chris Hipkins - the same man who welcomed BlackRock’s investments last year when he was Prime Minister.

Ultimately I expect the current government will succeed in loosening restrictions and our partisan legacy media will praise the opposition’s defiance while ignoring the hypocrisy of Chris Hipkins fighting the changes after accepting a massive investment from BlackRock while he was leading our governmet.

While I acknowledge the realpolitik of our current infrastructure crisis and that there is probably a place for public/private partnerships with multinational corporations in solving it, I think it is high time that all of our civic leaders brushed up on John Stuart Mill’s Utilitarianism - specifically the importance of government regulation in natural monopolies such as the energy market.

Hopefully a clearer understanding of this philosophic lens would help them to see a better pathway forward in the complicated modern world of public/private partnerships that can protect the people of New Zealand from predatory multinational corporations like BlackRock.

https://newsroom.co.nz/2024/11/27/solarzeros-final-outage-inside-the-collapse-of-publicly-financed-solar-firm/

https://www.stuff.co.nz/life-style/homed/houses/116849874/quirky-wellington-character-home-with-loft-beds-and-bags-of-potential

https://www.nzgif.co.nz/news-and-events/new-zealand-green-investment-finance-invests-in-solarzero-to-accelerate-the-growth-of-solar-and-battery-deployment

https://www.nzgif.co.nz/news-and-events/solarzero-announces-acquisition-by-blackrock-real-assets

I don’t want to sound like a climate denialist, I did put solar panels on my roof after all, but the difference between the IPCC reports about the actual effects of man-made climate change and the hysterical claims of some policy makers is shocking. For more information, here is Steven E. Koonin (Under Secretary for Science, Department of Energy, in the Obama administration):

https://www.nzgif.co.nz/news-and-events/nzgif-raises-more-international-finance-for-solar-energy-totalling-365m

https://www.rnz.co.nz/news/political/495339/pm-hipkins-hails-2b-blackrock-climate-investment-fund-for-renewable-energy

https://newsroom.co.nz/2024/11/27/solarzeros-final-outage-inside-the-collapse-of-publicly-financed-solar-firm/

https://www.legislation.govt.nz/act/public/2005/0082/latest/whole.html#DLM356887

https://www.linz.govt.nz/our-work/overseas-investment-regulation/decisions/2022-11/202200407

https://www.beehive.govt.nz/release/overseas-investment-changes-get-new-zealand-bench